The dollar fell against most major currencies on Wednesday, after data showed weakness in the U.S. housing sector, however, losses were limited by a rise in U.S. treasury yields and speculation over the next head of the Fed.

The Commerce Department said Tuesday U.S. homebuilding fell 4.7% to 1.127 million units in September, well below economists’ estimates of a 0.5% decline.

A sharp rise in U.S. Treasury yields, however, limited downside momentum in the dollar as speculation continues that the next Fed president will favour further tightening of monetary policy in contrast with Janet Yellen.

The euro and pound were also supported by investor expectations that both the European Central Bank and Bank of England will tighten monetary policy sooner-rather-than later.

Theresa May will be meeting with EU leaders in Brussels this afternoon, where negotiations on the Brexit will continue with specific reference to trade issues will take place.

In cryptocurrency markets Bitcoin fell on Wednesday amid fears of increased regulatory pressure after the Commodity Futures Trading Commission said that virtual tokens used in initial coin offerings were classified as securities.

Demand for bitcoin, however, remained strong as on October 25, Bitcoin Gold will be created, a new cryptocurrency which seeks to ease the current mining monopolies present in Bitcoin.

Today, the UK is to report on retail sales, the U.S. is to release the weekly report on jobless claims together with data on manufacturing activity in the Philadelphia region. Investors will also be focusing on Friday’s housing data from the U.S.

Investors also wait for news on Trump's decision on the Federal Reserve chair position. The White House said Wednesday Trump will announce his decision in the "coming days."

The euro gained slightly against the dollar on Wednesday, ending the day right below the 1.18 level following the worse than expected data on homebuilding and new building permits from the U.S.

However, rising treasury yields continue to boost the dollar together with speculation over the the next Fed chair which is expected to hold a more hawkish stance towards monetary policy than Janet Yellen.

For today, investors will be watching closely on data from the U.S. including jobless claims and manufacturing activity. Investors will also be focusing on Friday’s housing data.

Pivot: 1.1775

Support: 1.1775 1.1755 1.1735

Resistance: 1.1815 1.1835 1.186

Scenario 1: long positions above 1.1775 with targets at 1.1815 & 1.1835 in extension.

Scenario 2: below 1.1775 look for further downside with 1.1755 & 1.1735 as targets.

Comment: technically the RSI is above its neutrality area at 50.

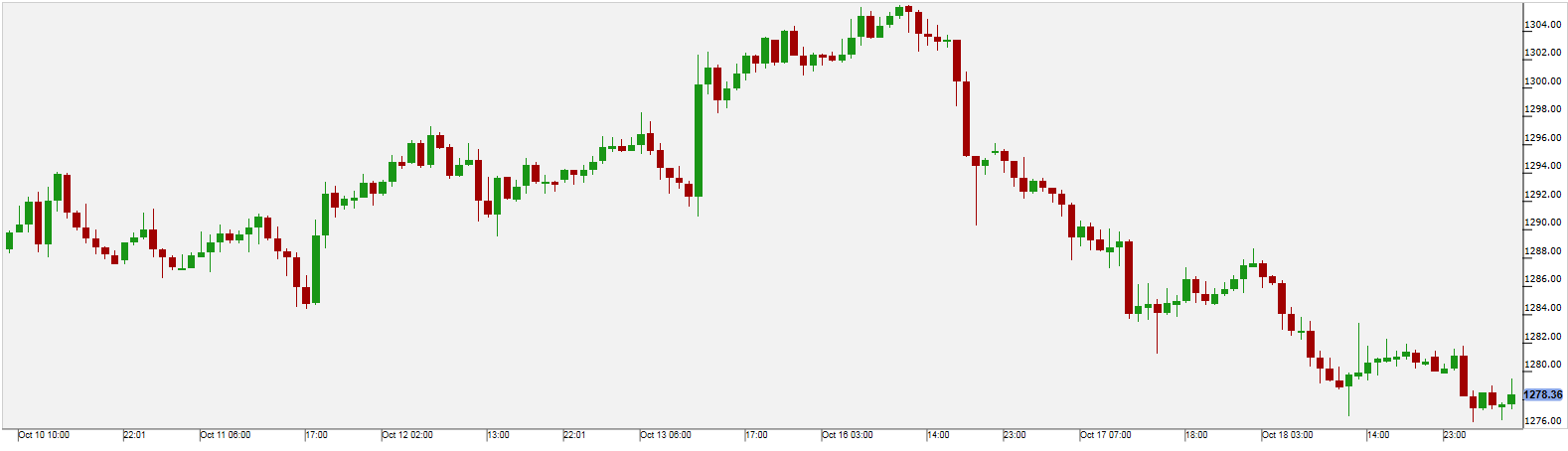

Gold

Gold prices continue to slide lower on Wednesday, following the recent boost in the dollar and on U.S. treasury yields, while growing speculation that the next head of the Federal Reserve will favour a more aggressive stance on monetary policy adds further pressure on the precious metal.

India tightened gold import norms for export houses by restricting them from importing the yellow metal only for export purposes and not for selling in the domestic market, the government said in a circular on Wednesday.

The precious metal has fallen sharply below the $1,300 level and investors will now focus on U.S. housing data to assess the economic impact of the hurricanes which hit the southern U.S. last month.

Pivot: 1284

Support: 1284 1289 1293

Resistance: 1291 1296 1300

Scenario 1: short positions below 1284.00 with targets at 1273.00 & 1270.00 in extension.

Scenario 2: above 1284.00 look for further upside with 1289.00 & 1293.00 as targets.

Comment: the RSI is capped by a bearish trend line.

WTI Oil

Crude oil prices moved higher on Wednesday, supported by data showing that U.S. inventories fell more-than-expected for a fourth straight week easing concerns over an expected increase in supply.

The price of crude oil is receiving an additional boost by ongoing supply cuts by OPEC, tensions in the Middle East and lower U.S. production due to hurricane-enforced closures.

Investors will continue to monitor developments in the Middle East, after the conflict in Northern Iraq between Iraqi and Kurdish forces eased, reducing concerns over potential supply disruptions in the region.

Pivot: 51.65

Support: 51.65 51.45 51.2

Resistance: 52.35 52.65 52.85

Scenario 1: long positions above 51.65 with targets at 52.35 & 52.65 in extension.

Scenario 2: below 51.65 look for further downside with 51.45 & 51.20 as targets.

Comment: even though a continuation of the consolidation cannot be ruled out, its extent should be limited.

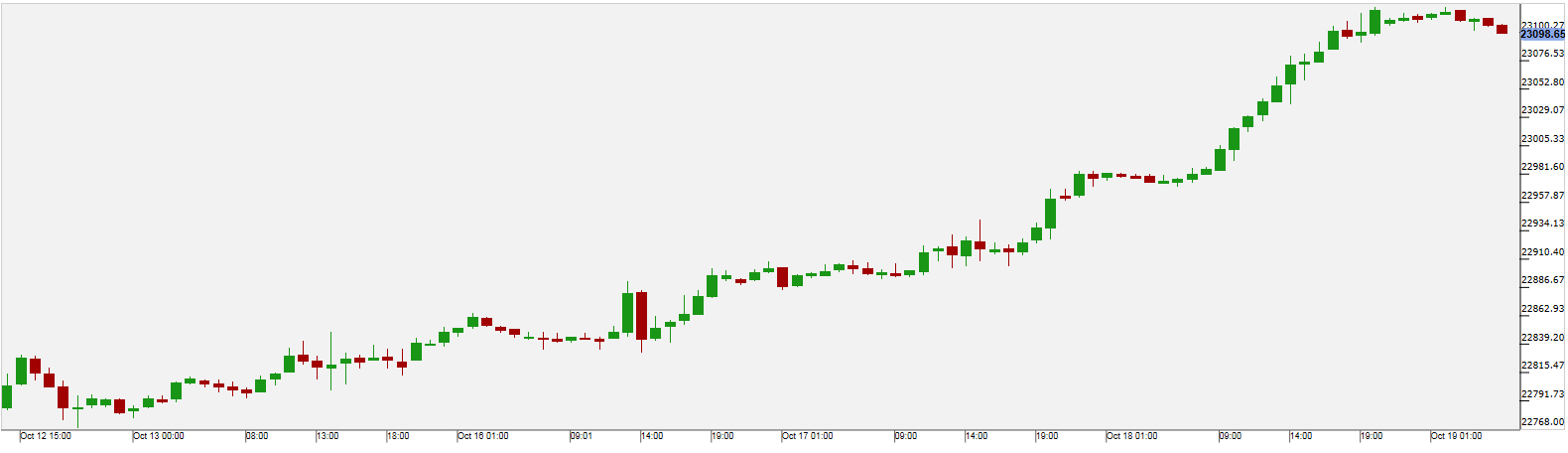

US 30

The Dow Jones Industrial Average closed above 23,000 for the first time on Wednesday, driven by a jump in IBM (NYSE:IBM) after it hinted at a return to revenue growth.

Shares of IBM which beat expectations on revenue, jumped 8.9 percent and accounted for about 90 points of the day's 160 point-gain in the index.

EBay Inc warned Wall Street on Wednesday that profit this quarter could fall below analysts' estimates as it invests in marketing and a revamped website to attract more shoppers, sending shares sharply lower.

Markets will continue to monitor earnings reports while waiting for Trump's decision on the Federal Reserve chair position. The White House said Wednesday Trump will announce his decision in the "coming days."

Pivot: 23050

Support: 23050 23000 22970

Resistance: 23150 23190 23250

Scenario 1: long positions above 23050.00 with targets at 23150.00 & 23190.00 in extension.

Scenario 2: below 23050.00 look for further downside with 23000.00 & 22970.00 as targets.

Comment: the immediate trend remains up and the momentum is strong.